RECAP OF 3rd Quarter 2025

NUMBER OF SALES

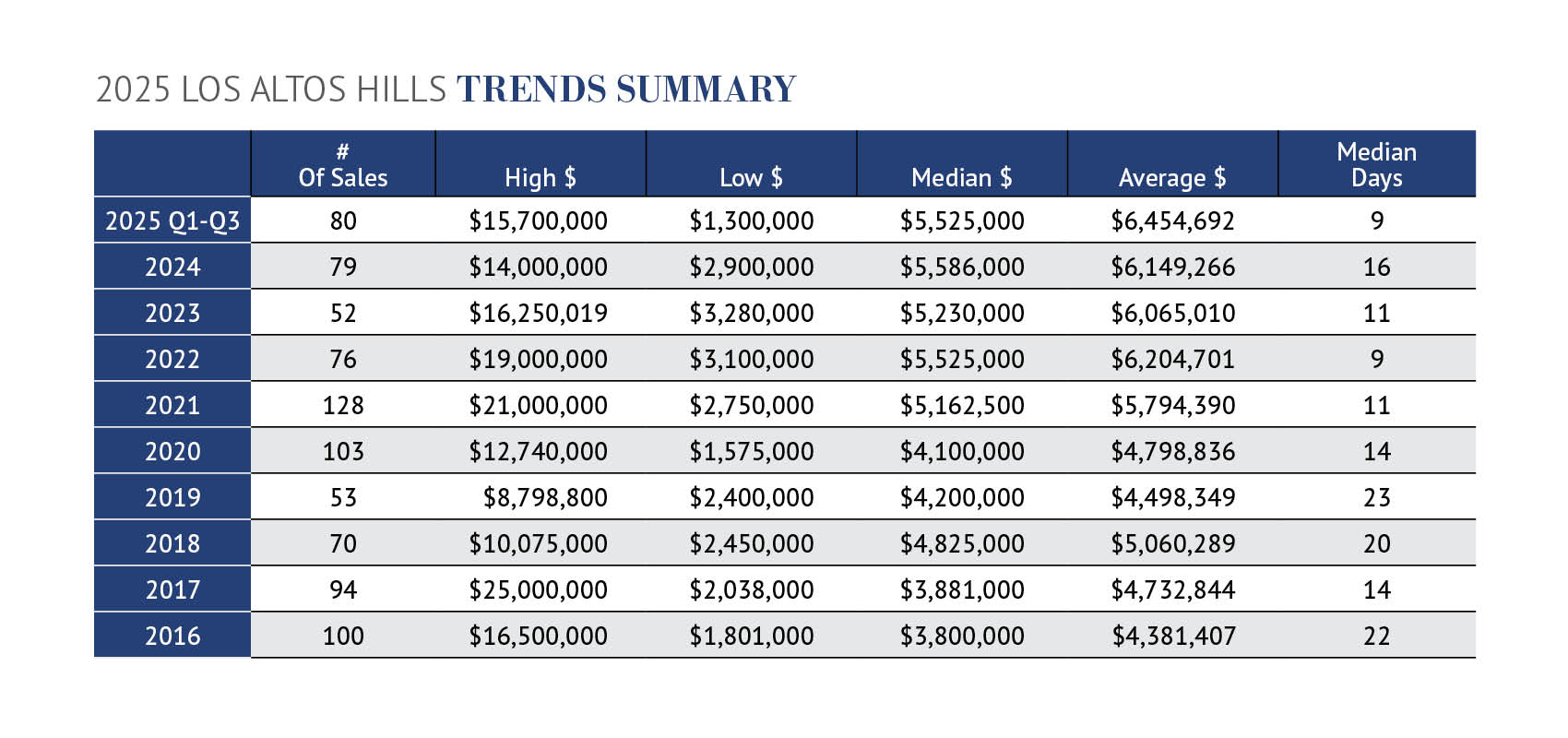

There were 33 sales in the 3rd quarter, 30 sales in the 2nd quarter, and 17 sales in the 1st quarter. This total of 80 sales through the 3rd quarter compares to only 54 sales in the same period last year – a 48% increase.

PRICES

Prices in the 3rd quarter were remarkably strong. The record-high average price was $6,660,206, attributed to 5 sales in excess of $10 million. The median price at $5,475,000 was not a record high. Year-to-date through the 3rd quarter, the average price was $6,454,692, which was a record high and up 5% compared to all of last year. The median price year-to-date was $5,525,000, a decline of just 1% compared to last year.

In the 3rd quarter, there were 5 homes sold for more than $10 million, 11 homes for more than $7 million, and only 4 homes that sold for less than $4 million. Of the 33 sales, 15, or 45%, sold for more than list price, including one of the most expensive sales in the quarter.

The price per square foot in the 3rd quarter was $1,634 – just a slight decline from last year when it was $1,635.

LENGTH OF TIME TO SELL

Homes sold quickly in the 3rd quarter with 58% of the sales occurring in 2 weeks or less. On average, homes in the 3rd quarter sold in 25 days, due to two sales taking more than 160 days; the median days on market was just 10.

OUTLOOK

As I reported to you in my 1st Half Report (find it at DavidTroyer. com/lahreport), the market growth this year has exceeded my expectations. Each quarter this year has reached a record high

average price. While some uncertainty remains, the stock market continues to reach new highs – a positive indicator for the real estate market, especially in our area. Based on the incredibly strong demand we have seen so far this year, I continue to expect this accelerated pace given the strong demand and limited inventory.

Los Altos Hills continues to be one of the most desirable places to live in the Bay Area and commands the second highest prices. The presence of excellent schools, its convenient location, and large lot sizes make it a smart investment for buyers, which is why property prices remain high.

With just 25 homes actively for sale (and another 3 homes being privately marketed), now is an opportune time to list your home for sale with The Troyer Group. Our team has a proven track record of helping sellers prepare their homes for sale quickly and effectively, and we are committed to getting you your price or more. Please do not hesitate to contact us. You have nothing to lose.

PRICES

Prices in the 3rd quarter were remarkably strong. The record-high average price was $6,660,206, attributed to 5 sales in excess of $10 million. The median price at $5,475,000 was not a record high. Year-to-date through the 3rd quarter, the average price was $6,454,692, which was a record high and up 5% compared to all of last year. The median price year-to-date was $5,525,000, a decline of just 1% compared to last year.

In the 3rd quarter, there were 5 homes sold for more than $10 million, 11 homes for more than $7 million, and only 4 homes that sold for less than $4 million. Of the 33 sales, 15, or 45%, sold for more than list price, including one of the most expensive sales in the quarter.

The price per square foot in the 3rd quarter was $1,634 – just a slight decline from last year when it was $1,635.

LENGTH OF TIME TO SELL

Homes sold quickly in the 3rd quarter with 58% of the sales occurring in 2 weeks or less. On average, homes in the 3rd quarter sold in 25 days, due to two sales taking more than 160 days; the median days on market was just 10.

OUTLOOK

As I reported to you in my 1st Half Report (find it at DavidTroyer. com/lahreport), the market growth this year has exceeded my expectations. Each quarter this year has reached a record high

average price. While some uncertainty remains, the stock market continues to reach new highs – a positive indicator for the real estate market, especially in our area. Based on the incredibly strong demand we have seen so far this year, I continue to expect this accelerated pace given the strong demand and limited inventory.

Los Altos Hills continues to be one of the most desirable places to live in the Bay Area and commands the second highest prices. The presence of excellent schools, its convenient location, and large lot sizes make it a smart investment for buyers, which is why property prices remain high.

With just 25 homes actively for sale (and another 3 homes being privately marketed), now is an opportune time to list your home for sale with The Troyer Group. Our team has a proven track record of helping sellers prepare their homes for sale quickly and effectively, and we are committed to getting you your price or more. Please do not hesitate to contact us. You have nothing to lose.

Rollover or click map to see more information for each area.

Rollover or click map to see more information for each area.